SAFE Federal Credit Union's routing number is: 253279691

Let's face it—finances can be confusing! From routing numbers to account suffixes, sometimes its hard to know what's what. SAFE wants to make sure you're informed and help you avoid delays—especially when it comes to your money! That's why we've put together some general, but important information about your SAFE Federal Credit Union account. Take a look:

What's my routing number?

SAFE Federal Credit Union's routing number is a nine-digit number that identifies us as the credit union for your financial transactions. SAFE Federal Credit Union has only one routing number for all our accounts:

253279691

Direct Deposit

Whether it's your paycheck, a bill payment, or your tax refund, one of the quickest ways to receive funds into your account is through direct deposit. Providing the correct account information is key to avoiding any mishaps with your employer or the IRS. here are some helpful guidelines to make sure you are submitting the correct information.

To deposit to your savings account:

- Routing Number: 253279691

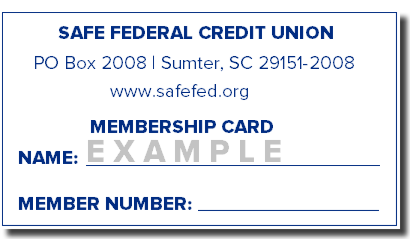

- Savings Account Number: This number is unique to every member and can be found on your Membership card (see example). Call us at 1-800-763-8600, or visit your nearest branch location if you need a replacement Membership Card.

- Account Type: Savings

To deposit to your checking account:

- Routing Number: 253279691

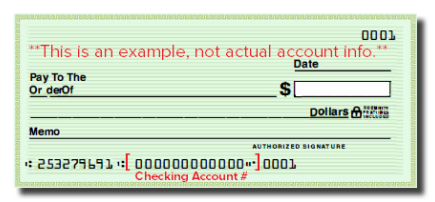

- Checking Account Number: This is a 10-digit number that is unique to every member and can be found at bottom, center of your checks (see an example). This number is what identifies your account. Call us at 1-800-763-8600, or visit your nearest SAFE branch location if you need help locating this number.

- Account Type: Checking

ACH Payments

Now days, most companies use ACH payment processing. ACH stands for Automated Clearing House—a financial network based in the United States used for electronic payments. It's basically a fancy way of saying "direct payments." It lets you send funds without using a credit or debit card, or writing a paper check. When submitting an ACH payment to a company (for example, paying your electricity bill online), you'll need to provide your checking account information, which includes:

- Routing Number: 253279691

- Checking Account Number: This is a 10-digit number that is unique to every member and can be found at bottom, center of your checks (see an example). This number is what identifies your account. Call us at 1-800-763-8600, or visit your nearest SAFE branch location if you need help locating this number.

- Account Type: Checking

Things to remember:

- SAFE Federal Credit Union has only one routing number: 253279691

- When posting to a savings account, you will need your member number/savings account number. Only primary accounts can receive ACH transactions (The Automated Clearing House, an electronic network for financial transactions in the United States. These transactions include, but aren't limited to: direct deposits, payoffs, vendor payments, tax refunds, etc.)

- When posting to a checking account, you will need the full ten (10) digit book number

Don't hesitate to let us know if you have any questions! A member of our friendly staff is just a call or click away! you can reach us at 1-800-763-8600, Option 2#.